Our Mileagewise - Reconstructing Mileage Logs Statements

Our Mileagewise - Reconstructing Mileage Logs Statements

Blog Article

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Table of ContentsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsSome Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs 4 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedMileagewise - Reconstructing Mileage Logs - TruthsAbout Mileagewise - Reconstructing Mileage LogsNot known Facts About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals Explained

Timeero's Fastest Distance function suggests the fastest driving route to your employees' destination. This attribute improves performance and contributes to cost financial savings, making it an essential property for companies with a mobile workforce.Such a technique to reporting and conformity streamlines the usually intricate job of managing mileage costs. There are several benefits linked with using Timeero to keep track of gas mileage.

About Mileagewise - Reconstructing Mileage Logs

With these tools in operation, there will be no under-the-radar detours to raise your compensation expenses. Timestamps can be discovered on each mileage entry, increasing reliability. These additional verification procedures will maintain the IRS from having a factor to object your mileage documents. With accurate gas mileage monitoring technology, your workers don't have to make harsh gas mileage price quotes or perhaps bother with gas mileage cost tracking.

As an example, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all car expenditures. You will require to continue tracking mileage for job even if you're making use of the actual expenditure technique. Keeping mileage documents is the only means to different business and personal miles and give the proof to the IRS

Many gas mileage trackers let you log your trips manually while calculating the distance and reimbursement amounts for you. Several additionally come with real-time journey monitoring - you require to start the app at the start of your trip and quit it when you reach your last destination. These apps log your begin and end addresses, and time stamps, in addition to the complete distance and compensation amount.

Excitement About Mileagewise - Reconstructing Mileage Logs

Among the questions that The INTERNAL REVENUE SERVICE states that lorry costs can be considered as an "common and necessary" expense throughout operating. This includes expenses such as gas, upkeep, insurance policy, and the car's depreciation. Nonetheless, for these expenses to be taken into consideration insurance deductible, the car needs to be used for organization purposes.

Get This Report about Mileagewise - Reconstructing Mileage Logs

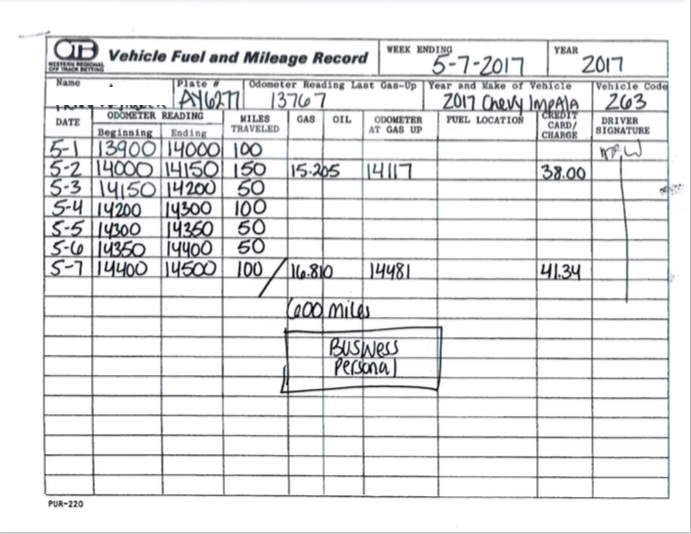

Beginning by taping your car's odometer reading on January 1st and after that once again at the end of the year. In between, vigilantly track all your service trips writing the beginning and finishing analyses. For each and every journey, document the location and organization objective. This can be streamlined by maintaining a driving visit your cars and truck.

This includes the complete service gas mileage and overall mileage buildup for the year (service + individual), trip's day, destination, and objective. It's important to tape-record activities without delay and keep a synchronous driving log outlining date, miles driven, and organization function. Here's just how you can enhance record-keeping for audit functions: Start with ensuring a careful mileage log for all business-related traveling.

The 8-Second Trick For Mileagewise - Reconstructing Mileage Logs

The actual costs approach is a different to the typical mileage price approach. Rather than calculating your reduction based upon a predetermined rate per mile, the actual expenditures technique enables you to subtract the real prices associated with using your car for business functions - free mileage tracker app. These prices include fuel, maintenance, repair services, insurance policy, devaluation, and various other relevant expenses

However, those with considerable vehicle-related costs or special problems might take advantage of the actual costs technique. Please note electing S-corp standing can alter this calculation. Inevitably, your selected approach ought to align with your particular economic goals and tax scenario. The Standard Gas Mileage Rate is a procedure issued annually by the internal revenue service to identify the insurance deductible costs of running a vehicle for business.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

(http://www.place123.net/place/mileagewise-reconstructing-mileage-logs-dania-beach-united-states)Compute your overall organization miles by utilizing your start and end odometer analyses, and your tape-recorded organization miles. Properly tracking your exact gas mileage for business trips help in validating your tax obligation deduction, specifically if you opt for the Criterion Mileage technique.

Maintaining track of your these details gas mileage manually can need persistance, yet remember, it might conserve you cash on your taxes. Tape the overall gas mileage driven.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

And currently almost everyone uses General practitioners to obtain about. That indicates almost every person can be tracked as they go about their company.

Report this page